TurboTax ® is a registered trademark of Intuit, Inc. If you know the amount of IRS taxes you owe, click the link below to either pay via bank direct transfer, credit card, wire, check/money order or by cash.

FILE EXTENSION 2016 TAXES CODE

For returning to, use promo code ext40efile to save 40% when you complete and e-file your 2021 Tax Returns - IRS and states - by October 15, 2022. Once you are satisfied with your return, have reported all of your tax forms, and are ready to file, go through the eFile checkout process. Once everything is present, click File to see your return. Report all of your information here and go over any forms you may have reported previously. Here, you will see the usual preparation and filing screen. Return to your account and click the Work on Return item on the menu. 15, 2022, get your forms together and pay any due tax - as much or little as you can. Step 3: Filing your Tax Return after the ExtensionĪfter the IRS (and applicable state) has accepted your tax extension, you have been granted time to prepare. If you do not know what you owe, create a free working copy 2021 tax return - click on your My Account and review the state return - pay the state tax amount, then pay your taxes by state online here.

FILE EXTENSION 2016 TAXES PDF

Once your IRS extension has been eFiled, click on My Account and then on the PDF icon to download your PDF file for the IRS extension.įor most states, if you pay the state taxes you owe by the due date, that payment serves also as a state tax extension. You must click e-File Extension in order for it to be eFiled. However, you can also pay directly at the IRS site via this link: Ĭlick on the link in the text "clicking here" to review your extension before you eFile it. If you owe taxes, you can click on the second link.

FILE EXTENSION 2016 TAXES FOR FREE

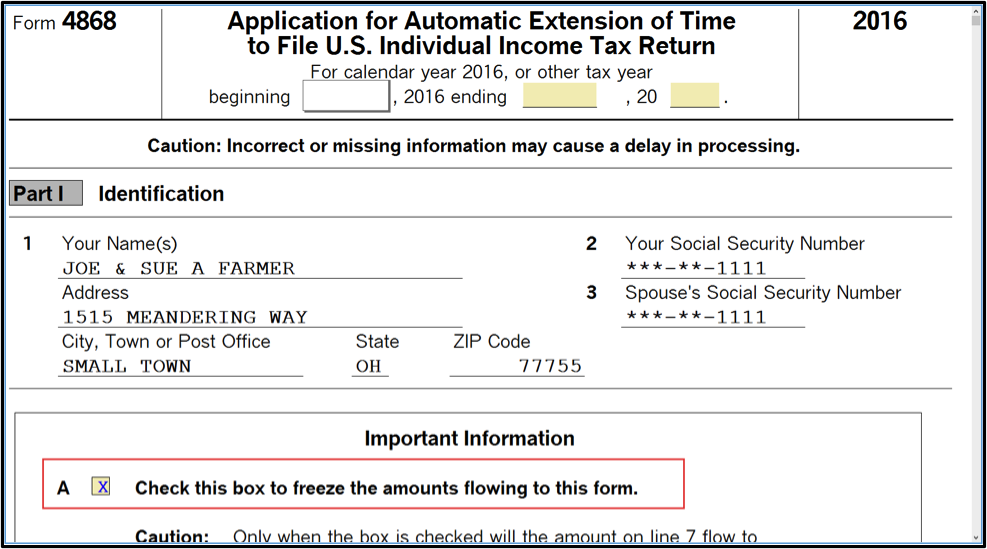

Sign Up for a Free Account | Or Sign In to your existing Account.Īfter sign in, follow the steps below to prepare and eFile an IRS extension for free on .įill in some simple information to identify yourself to the IRS. If you do not know what you owe, create a free working copy 2020 tax return and see what you owe - in your My Account on - and pay that amount, then pay your taxes by state online here For most states, if you pay the taxes you owe, that serves also as a state tax extension.If you owe IRS taxes, you can pay them via bank direct transfer, credit card, wire, check/money order, or cash here: Pay IRS or Federal Taxes Online.If you don't know the amount or IRS or Federal Taxes and/or State Taxes you owe, create a free working copy 2021 tax return and see what you owe - in your My Account on - and pay that amount. Pay state taxes online - see instructions below. You can eFile a free IRS Tax Extension, not state tax extensions.

Estimate your tax penalty to see how much you may owe the IRS.Īfter April 18, 2022, the last day to e-File your 2021 return(s) is October 15: If you owe taxes, e-File something (return or extension) even if you can't pay anything now! After Oct.

Most State Extension Deadlines are April 15, April 18, and some are May 1, 2022.Į-Filing a tax return or tax extension by Apwill eliminate a late filing penalty, not the late tax payment penalty, if you don't pay your taxes due by April 18. The IRS typically begins accepting tax extensions in mid March and the return/extension deadline is April 18, 2022.

0 kommentar(er)

0 kommentar(er)